Business requirement

Fec declarations are reports for the fiscal audit and it is regarding different kind of entry:

– Main account.

– Customer balance;

– Vendor balance;

– Customer transaction;

– Vendor transaction.

– Other transactions related to customers and vendors (es. Invoice to be received, cost of good sales, inventory issue, etc.…)

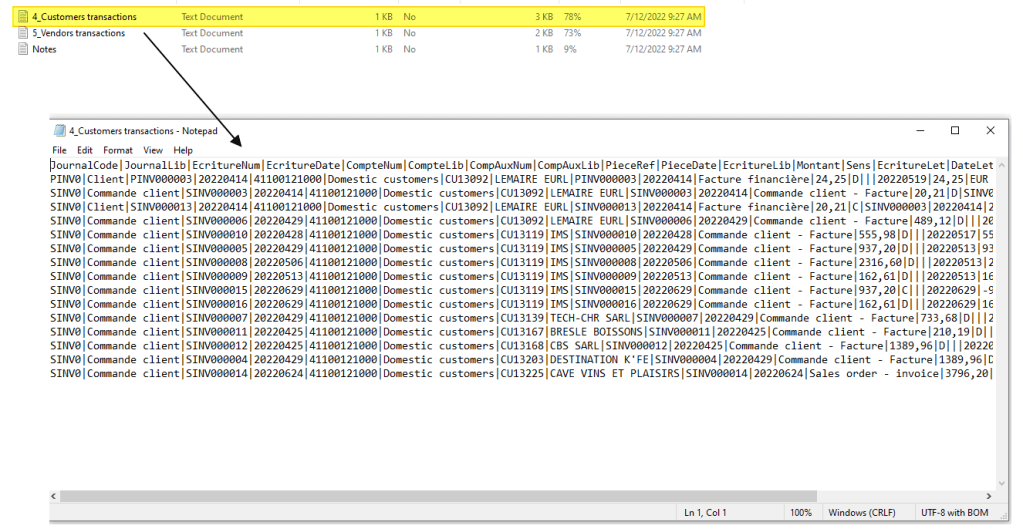

Consider that each entry type is a separate txt file.

Configuration

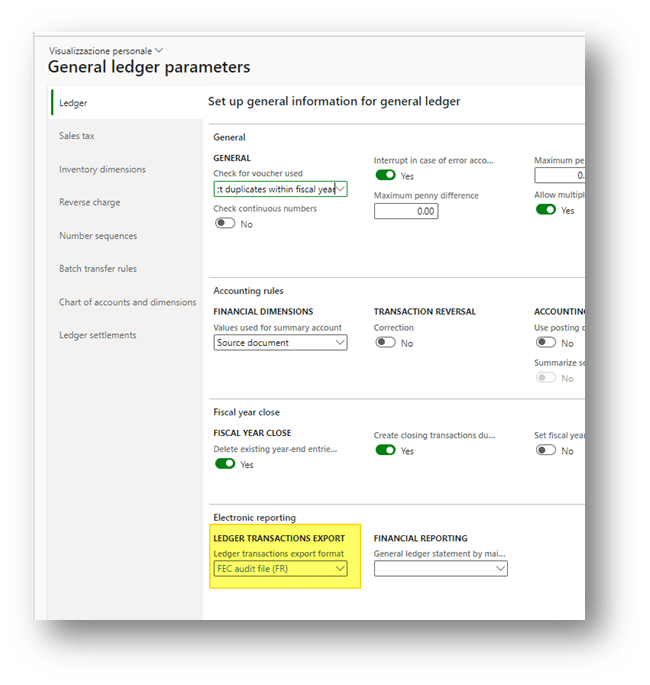

Electronic report

- Import from the Microsoft Global repository the last version of the following ER:

General ledger

Then, on the general ledger setup set the ER imported:

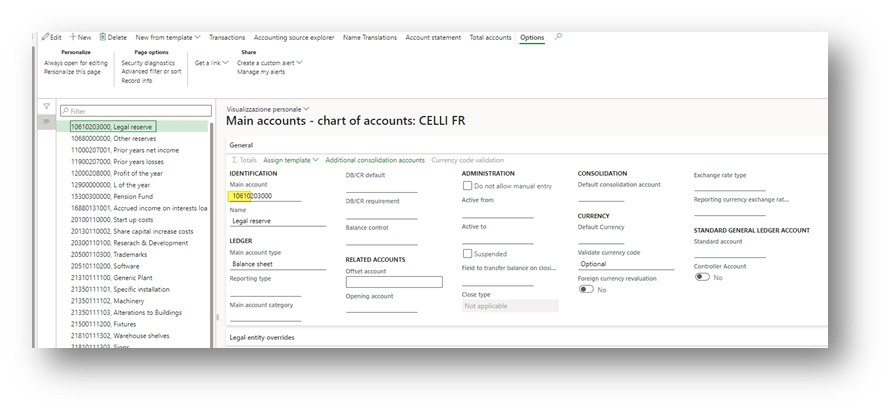

Main account

- In accordance with the k-user, inset the account number agreed for the French localization. Remember the first 3-5 numbers are the number of the FEC:

As alternative, if we want to use a financial dimension to track the Legal French account number, we recommend to following the instruction in this article: https://axaptamasters.com/electronic-reporting-in-d365-replacing-existing-field-with-a-financial-dimension-in-an-outgoing-report-structured-as-a-zip-of-text-files/

Voucher

- Set the voucher structure in accordance with the k-user Fec specification. The voucher to be focused on are:

– Customer packing slip

– Sales Invoice

– Customer payment journal

– Vendor product receipt

– Vendor invoice

– Vendor invoice journal

– Vendor invoice payment journal

– Stock journal

– Production order journal

Process

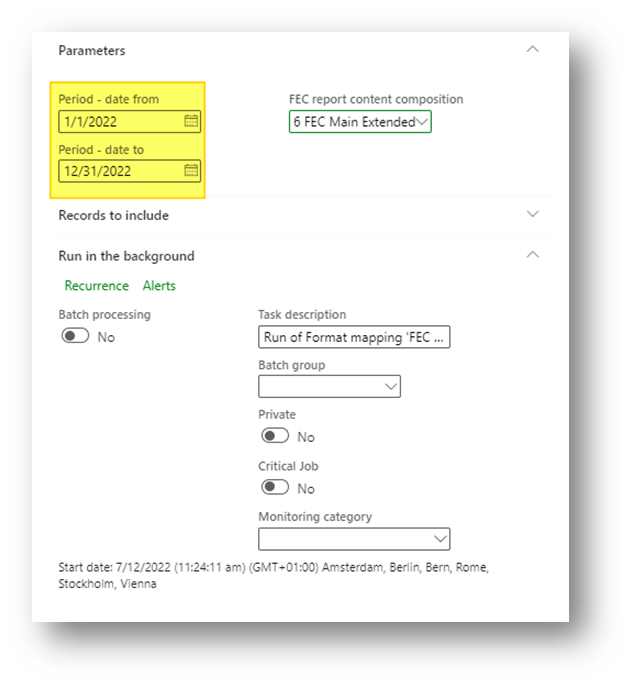

Go to: General ledger> Periodic tasks> Data export.

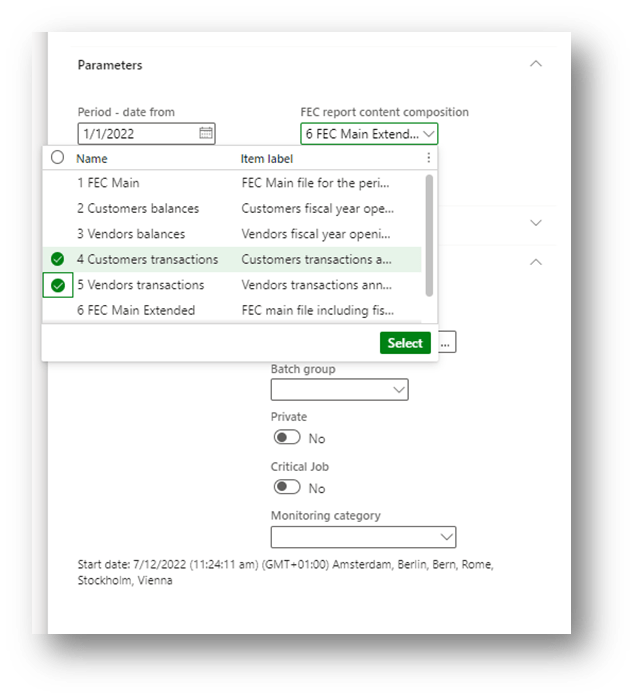

Select the:

– Range of time:

– The elements that you would like to integrate into the exportation:

Perform the extraction to have the Fec declaration:

Source: https://docs.microsoft.com/en-us/dynamics365/finance/localizations/emea-fra-fec-audit-file-structure

Leave a comment