This article is a collection of tips to adapt the Invoice register procedure to the Italian Fiscal requirement. There are few things to consider to correctly handle this business process to avoid an uncompliant sales tax registration. An assumption to better understand the phenomenon, in Italy, each invoice document can have only a unique voucher registration on the tax register, following a precise structure and chronological order. So the problem is when we post an invoice from the invoice register we have two vouchers: the first related the invoice register, the second relead the pending invoice registration.

The clue question to ask to be sure to architect correctly the solution is: What is the purpose for the k-user of the invoice register? If it’s to record immediately the sales tax, there is a solution; if it’s to recognize the sales tax on the pending invoice registration but anticipate vendor due, it’s another solution. Remember, we have two vouchers in this case, but just one of them, can be consumed to recognize the sales tax invoice document.

Case 1: The business requirement is to record immediately the sales tax to deducte

In this case, the solution is to recognize as a voucher invoice document the post made by the “invoice register” and make fiscally invisible the second voucher post by the “pending invoice”. To perform that takes care on this points:

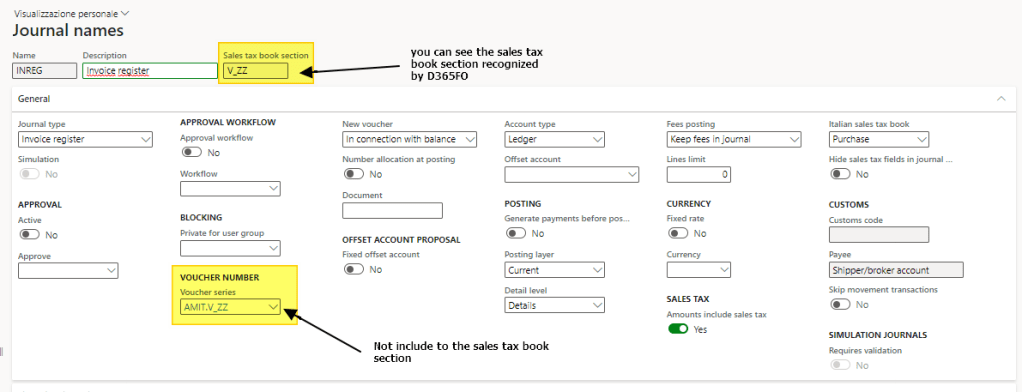

- Invoice register: Set a voucher link to a section tax book included on the vat register:

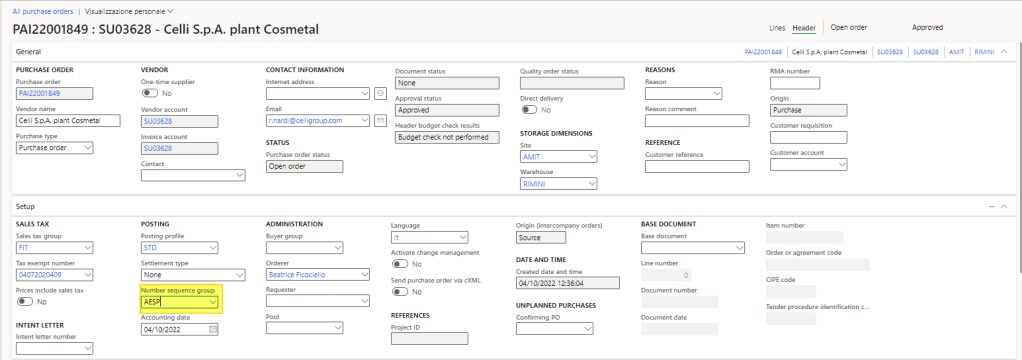

- Purchase order: In the business process, for each purchase order involved in the invoice pending registration, you should perform an activity before recovering the invoice from the “invoice pool”. In the purchase order header, manually change the number sequence group to link an section tax book not included on the vat register. At standard, it’s not possible to change the number sequence group on the pending invoice (we inherit the information):

The last point to highlight is that we will have three records on the TaxTrans at the end of the process. The first is the record made by the invoice register. The pending invoice makes the last two records: one is the write-off of the record made by the invoice register, and the last is the reinsertion of the sales tax invoice made my the pending invoice.

So remember the document master to recognize the sales tax is the invoice register. The k-user should be concerned that after the pending invoice, it’s necessary to use the same sales tax group combination used on the invoice register (because the pending invoice undergoes the decision taken on the invoice register).

Case 2: The business requirement is to record immediately invoice due and recognize the sales tax on the pending invoice

In this case, the solution is to recognize as a voucher invoice document the post made by the “pending invoice” and make fiscally invisible the voucher post by the “invoice register”. To perform that takes care on this points:

- Invoice register: Set a voucher link to a section tax book not included in the vat register:

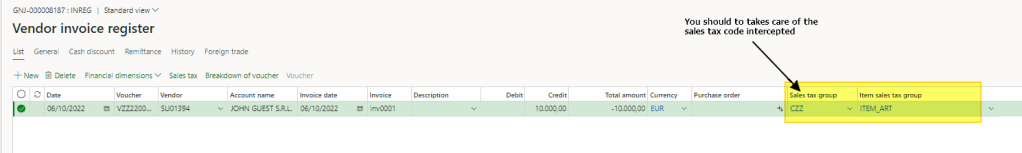

- Invoice register: In the business process, remember to use a sales tax group combination to intercept the sales tax code with a period not included in the sales tax settlement.

So as mentioned previously, the last point to highlight is that we will have three records on the TaxTrans at the end of the process. The document master to recognize the sales tax competence is the invoice pending. The k-user should be concerned about the sales tax recording only during the pending invoice registration.

Conclusion

I recommend the second way because the impact of the business process activities to record the purchase invoice is lesser. That depends on the term available to register the invoice, but usually, because it’s regarding the sales tax to be deducted, the time is long (60 days or more in base the sales tax settlement declaration). Furthermore, the area to focus to reduce this term can be the trade agreement importation, procurement approbation workflow, inbound process, or vendor agreement between the date of items put in transit and invoice date.

Leave a comment