Architectural perspective

There are different ways to capitalize your cost in a Fixed asset. However, before evaluating the best path, starting with a brief resume of the accounting phenomenon can be beneficial.

Capitalization is used when we want to move a cost to an actual period to a pluriannual asset. For example, imagine buying cell phones that the company intends to use as a free good to distribute during a promotion campaign. Our promotion can be: if you buy from us for more than 10.000 dollars, we give you an iPhone as a gift. Those cell phones are born at cost because they aim to provide them for free.

However, imagine, for some reason, some cell phones are in stock at the end of the promotion, and we want to reuse them for internal purposes (like giving them as extended benefits to the workers). In this second scenario, we need to capitalize on these cell phones because they become internal assets. We will have a general entry like this:

| ID | Event | Main account | Debit | Credit |

| 1 | Capitalize cost | Multimedia | 900 | |

| 2 | Capitalize cost | Fixed asset | 900 |

D365FO provides several alternatives to capitalize them. In all of them, the fixed asset master data should already be created in the system. Below is a quick list and description of the alternatives:

| Solution | Description |

| Journal entry | It’s a strictly general entry. That means we move only the general ledger and not the inventory. It is ideal to capitalize services or unstocked items. It’s not mandatory to use the fixed asset module. For more details, you can see this article: link |

| Inventory | We post a movement issue as an inventory journal. It is ideal to capitalize stock items. It is mandatory to manage the fixed asset module if the process is synchronous with the inventory. For more details, you can see this article: link |

| Project investment | We absorb the cost element using an investment project. The project can allow us to track the transaction to capitalize with more accuracy and details (like hour time, expense categories, etc…). It is mandatory to manage the fixed asset module if the process is synchronous with the inventory. For more details, you can see this article:https://daxmsdynamics365.wordpress.com/2024/03/05/project-investment-to-fixed-assets-journal/ |

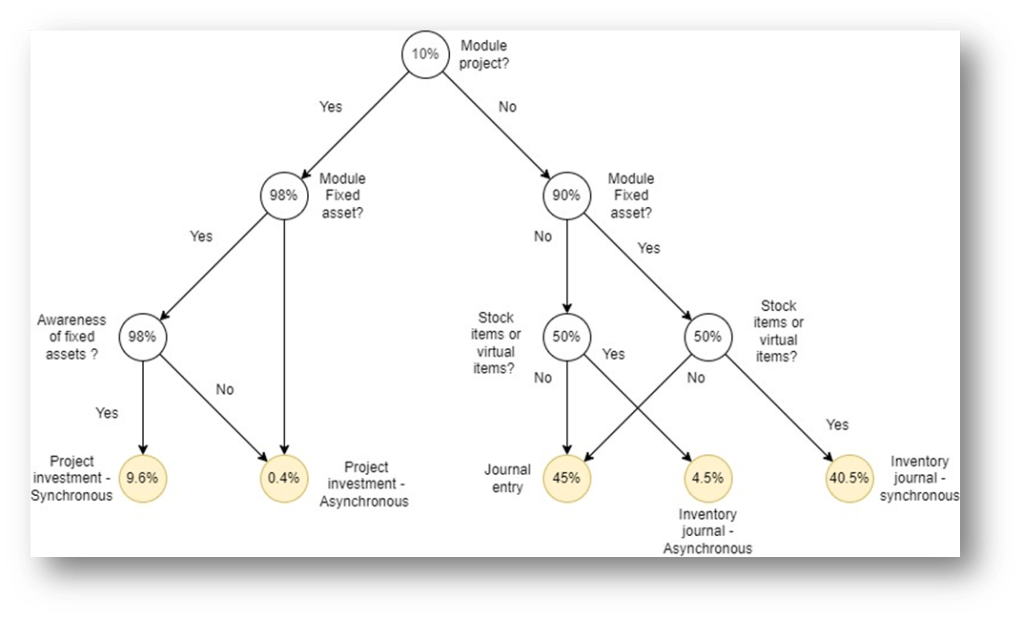

As you have seen, we have several alternatives to manage capitalization. The decision about the best way to follow is based on those variables. Those variables depend on the business module of your company and the volume to manage:

- Implementation of the project module: Typical for a company with a medium-high volume of asset transactions;

- Capitalization also of the stock items: Typically for manufacturing companies;

- Using the project to track the capitalization: typically for big internal projects, where the project modules are already implemented for other reasons (es. machinery industry-based production to order)

- Awareness of fixed assets to capitalize: The k-use knows exactly which fixed asset to capitalize at the moment to post the consumption;

This tree proposes the best solution to implement based on the variable identified. To optimize your training (for the analysis), I’ve also inserted my estimation of the true brackets scenario. In the end, we can see an estimation of the business solution in real life.

Off-topic – Personal anecdote

Originally, I would like to write an article only regarding the capitalization from the project module. However, like Hal in Malcolm, an explanation raises the necessity to give better explanations about other matters, in the end, I finished creating this paper: https://www.youtube.com/watch?v=AbSehcT19u0

Leave a comment